Next Chapter

Booktalking "You've Earned It, Don't Lose It: Mistakes You Can't Afford to Make When You Retire" by Suze Orman

Suze Orman describes this book perfectly when she says that "It is a lifestyle book that deals with the financial issues of retirement." However, this is definitely not solely a book for senior citizens. Having a successful, financially feasible retirement depends on good planning, which commences years before a person retires. Therefore, it is a great read for anyone who is curious about these issues and who wants to ensure that their later years are, in fact, golden.

Suze Orman describes this book perfectly when she says that "It is a lifestyle book that deals with the financial issues of retirement." However, this is definitely not solely a book for senior citizens. Having a successful, financially feasible retirement depends on good planning, which commences years before a person retires. Therefore, it is a great read for anyone who is curious about these issues and who wants to ensure that their later years are, in fact, golden.

Things to consider include wills, trusts, long-term care insurance and the potential loss of a partner. All of these things can affect your financial planning and what happens when you die. Make sure you make your wishes known in terms of your estate, "your right to die," and funeral arrangements. Don't create additional stress on loved ones by letting these decisions remain ambiguous.

You've Earned It, Don't Lose It: Mistakes You Can't Afford to Make When You Retire by Suze Orman, 1999

You can always find stories in the news and television programs about retirement woes and how people lose their money through bad investments, etc. However, this book is not only for senior citizens. A lot of planning goes into retirement and younger people need to contemplate these issues long before they are ready to retire.

You can always find stories in the news and television programs about retirement woes and how people lose their money through bad investments, etc. However, this book is not only for senior citizens. A lot of planning goes into retirement and younger people need to contemplate these issues long before they are ready to retire.

Financial Advisors: Orman recommends that people do not completely trust a financial advisor without checking them out first. Some people fall prey to what Suze calls the "guardian angel syndrome." Read documents in their entirety before you sign them, and never sign blank contracts or pieces of paper.

Wills and Trusts: Unless you have a trust in addition to a will, portions of your estate can be eaten up by lawyer's fees after you die. The estates of individuals without a will are subject to intestate; the court takes control of your estate and siphons it off according to the succession laws of the state in which you resided. For example, the laws of New York State dictate that the estate will go to the spouse. If no spouse exists, the estate will go to the children, then parents, then siblings, etc. Surprisingly, there is such as thing as a "right to die." However, this needs to be on your will if you would like to be taken off of life support if two doctors determine that you will not regain consciousness. If you become comatose and unable to express your right to die, life support will continue.

Wills and Trusts: Unless you have a trust in addition to a will, portions of your estate can be eaten up by lawyer's fees after you die. The estates of individuals without a will are subject to intestate; the court takes control of your estate and siphons it off according to the succession laws of the state in which you resided. For example, the laws of New York State dictate that the estate will go to the spouse. If no spouse exists, the estate will go to the children, then parents, then siblings, etc. Surprisingly, there is such as thing as a "right to die." However, this needs to be on your will if you would like to be taken off of life support if two doctors determine that you will not regain consciousness. If you become comatose and unable to express your right to die, life support will continue.

Long-term care (LTC) insurance is another option to consider when planning for your retirement. Nursing home costs can be up to $100,000 per year, and the chance of ending up in a nursing facility is 33%. One in three. Therefore, it can be very helpful to purchase long-term care insurance if you have enough money for that. Also, refinancing your home can be beneficial if current interest rates are at least 1% to 2% lower than current mortgage.

Early Retirement: Can You Afford It?: For those that can afford it, early retirement can be a good option for them. However, there are some things to consider. For example, losing a partner tends to increase, not decrease expenses, as some people believe. Statistics indicate that women tend to outlive men. Most financial problems are caused by monthly living expenses that exceed monthly living income.

Early Retirement: Can You Afford It?: For those that can afford it, early retirement can be a good option for them. However, there are some things to consider. For example, losing a partner tends to increase, not decrease expenses, as some people believe. Statistics indicate that women tend to outlive men. Most financial problems are caused by monthly living expenses that exceed monthly living income.

In general, I love The Suze Orman Show on television. I find Suze to be very entertaining and personable. For example, she advises people who are young and single with no dependents to not purchase life insurance. That is good advice; however, I do not agree with everything she says. For example, she advises people to invest in stocks and purchase long-term care insurance if they can afford it. Those are high-risk and low-risk propositions, respectively. I take the opposite approach and I invest in safer money market accounts and I do not purchase long-term care insurance; low-risk and high-risk situations, respectively. I think that people should take Orman's general advice and apply it to their particular situations.

Luckily, our union offers many services, and I was able to receive the help of one of our attorneys, who prepared a will for me free of charge at the union headquarters in lower Manhattan. My mother encouraged me to create a will; I was continually surprised by the benefits that our union has; not only do they provide tenants' services, they also sell pet insurance!

Luckily, our union offers many services, and I was able to receive the help of one of our attorneys, who prepared a will for me free of charge at the union headquarters in lower Manhattan. My mother encouraged me to create a will; I was continually surprised by the benefits that our union has; not only do they provide tenants' services, they also sell pet insurance!

Write a Will! I cannot stress enough how important it is to have a will prepared. I learned much in the process of creating my will about the legal issues surrounding wills. It was fun, and my attorney was informative. Much of my estate has designated beneficiaries, but I need an executor to make sure that the beneficiaries know about the funds so that they can collect them and distribute my other property. Honestly, my three cats are the only important things in my house, and I also wanted the will in order to arrange for their care should I pass before them. It is tempting to think and believe that things will take care of themselves if you die, but it is good to have a plan in place. It can create a lot of unnecessary work for other people if you do not express your wishes.

Books by Suze Orman

Books by Suze Orman - America's Health Insurance Plans

- Association for the Advancement of Retired Persons (AARP) I found a great web page on this site of work opportunities for retired teachers.

- Financial Planning Association

- Health Insurance Association of America

- International Association of Registered Financial Consultants

- National Association of Personal Financial Advisors

- National Council on Aging

- New York State & Local Retirement System

- Social Security Retirement Benefits

- US Office of Personnel Management Retirement Resources

- USA.gov Retirement Resources

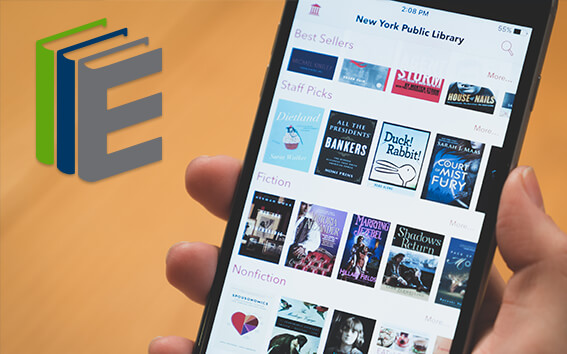

Read E-Books with SimplyE

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

If you don’t have an NYPL library card, New York State residents can apply for a digital card online or through SimplyE (available on the App Store or Google Play).

Need more help? Read our guide to using SimplyE.

Comments

Pension

Submitted by wealth-builders (not verified) on January 29, 2020 - 5:31am