Connect the Dots: Personal Finance, the Malcolm S. Forbes Award and... Fraud?

Steve Forbes presents award to NYPLWhat do the late Louis Rukeyser of Wall Street Week, Jonathan Clements of the Wall Street Journal, Consuelo Mack, anchor for PBS Wealth Track, Maria Bartiromo of CNBC, Don Phillips of Morningstar, Muriel Siebert, first woman to own a seat on the NYSE, Jean Chatzky, financial editor of the Today Show, Ben Stein, economist, and NYPL's business library, SIBL, have in common? All are winners of the Malcolm S. Forbes Public Awareness Award for Excellence in Advancing Financial Understanding. Named in honor of the late Malcolm S. Forbes, this award is given each year to the person or organization whose contributions have advanced financial education for the public.

Steve Forbes presents award to NYPLWhat do the late Louis Rukeyser of Wall Street Week, Jonathan Clements of the Wall Street Journal, Consuelo Mack, anchor for PBS Wealth Track, Maria Bartiromo of CNBC, Don Phillips of Morningstar, Muriel Siebert, first woman to own a seat on the NYSE, Jean Chatzky, financial editor of the Today Show, Ben Stein, economist, and NYPL's business library, SIBL, have in common? All are winners of the Malcolm S. Forbes Public Awareness Award for Excellence in Advancing Financial Understanding. Named in honor of the late Malcolm S. Forbes, this award is given each year to the person or organization whose contributions have advanced financial education for the public.

How, you might ask, did the New York Public Library end up in such august company? When Tim Forbes of Forbes Digital presented the award to me as SIBL's director, at the Financial Planning Association of New York (FPA-NY) Spring Forum, I used my acceptance remarks to provide the 250 strong audience an overview of the notable expansion in financial education at NYPL from a niche business library service to a broad-based NYPL mission. A brief reprise of these remarks follow below.

For the past decade personal finance education was centered at SIBL where, leveraging the financial expertise of a seasoned staff consultant, we developed a robust curriculum of a dozen classes taught by this specialist and librarians. The Library supplemented these with after-work presentations by experts from the FPA-NY, the Financial Women’s Association and government agencies like the Department of Labor and the SEC.

When, in 2009, with the generous support of McGraw-Hill, Financial Literacy Central was launched, SIBL added an advisory service where New Yorkers receive free, one on one counseling from Financial Planning Association of New York certified financial planners. Soon independent advisors like Steve Poppel joined the cohort of advisors. (Don't listen to me when I crow about this service. Read the patron reviews.) In 2011 SIBL added two new services, assisted e-filing of tax returns and Credit Crisis counseling by financial fitness coaches from the Community Service Society. The Bronx Library Center started to host a Single Stop Office where, twice weekly, a specialist advises patrons regarding eligibility for up to 40 benefit programs. The NYPL began organizing Financial Empowerment Days at SIBL, with an eye to expanding these full day extravaganzas to other interested sites in the future.

In 2011 McGraw Hill once again provided the funding for a new financial education initiative, Money Matters, which provides resources and programming at five financial education centers in the Bronx, Manhattan, and Staten Island. In its first year of operation, Money Matters offered close to 100 programs across the system, in these designated centers and in a dozen other branches, which offered “one-off” sessions on topics such as budgeting for the holidays and saving for college. Come tax season, assistance by trained volunteers was available at a number of branches across NYPL. Not all of the efforts were directed at adults. For the past three seasons a dozen NYPL branches have offered a series of after school sessions on personal finance for teens in which volunteers from High Water Women, use a curriculum from the Muriel Siebert Foundation, which has been adopted by several states.

A corollary to this much broadened financial education outreach to the general public is the need for NYPL staff to feel confident and empowered to make informed referrals to the most appropriate and authoritative web-based resources for personal finance. In 2011 NYPL was awarded a Laura Bush 21st century grant from the Institute for Museum and Library Services to train front line public services staff across the system. This 2-year initiative, also called Money Matters, was launched in January 2012 with a robust curriculum of in-person and e-learning modules developed by two renowned financial educators from the Rutgers University, Dr. Barbara O’Neill and Carol Glade. The participants’ reception to this hands-on training in areas such as banking and credit, retirement, and the basics of investing, has been highly enthusiastic. To date staff from more than half of the NYPL branches have attended sessions.

The Financial Planning Association iof New York is not alone in recognizing the Library. NYPL was invited to join, as a founding partner, the New York Coalition for Financial Education where we presented at its first Financial Education Showcase last spring. NYPL's evolving broadly based financial education efforts have nabbed the Library a spot in the NYC Office of Financial Empowerment Online Directory, the Financial Education Network.

Immediately following the awards ceremony, the Forum keynoter, Tom Ajamie, addressed the issue of financial frauds, a particularly timely topic in a post-Madoff environment. As an attorney who represents swindled investors, Ajamie has amassed sufficient firsthand material for his book titled Financial Serial Killers: Inside the World of Wall Street Money Hustlers, Swindlers, and Con Men. His bottom-line advice to the financial professionals in the audience was to ask lots of questions for both one's individual and institutional clients. The one sure way to finger a financial con artist is to assume nothing and to pepper the seller with incisive questions. This precisely replicates the advice from the SEC, FINRA and Better Business Bureau respresentatives who present in NYPL's Money Matters series: ASK QUESTIONS. Never invest with anyone who avoids giving you detailed, verifiable answers to whatever worries, puzzles, or astounds you.

While we wait for Ajamie's book to hit the Library shelves, here are a few additional resources available at SIBL and system-wide about schemers who predate Madoff, including the man who gave Ponzi scheme its name.

- The Match King: Ivar Kreuger, The Financial Genius Behind a Century of Wall Street Scandals / Frank Portnoy

- Need and Greed: The Story of the Largest Ponzi Scheme in American History / Stewart L. Weisman

- Ponzi: The Incredible True Story of the King of Financial Cons / Donald Dunn

To track congressional investigations into how government watchdog agencies failed to spot Madoff, you can dip into these legislative reports from home with the click of a link.

- Meeting on Assessing the Madoff Ponzi Scheme and the Need for Regulatory Reform

United States. Congress. House. Committee on Financial Services. - Oversight of the SEC Inspector General's Report on the "Investigation of the SEC's response to Concerns Regarding Robert Allen Stanford's Alleged Ponzi Scheme" and Improving SEC Performance

United States. Congress. Senate. Committee on Banking, Housing, and Urban Affairs. - The Stanford Ponzi Scheme: Lessons from Protecting Investors from the Next Securities Fraud

United States. Congress. House. Committee on Financial Services. Subcommittee on Oversight and Investigations. - Oversight of the Securities and Exchange Commission's Failure to Identify the Bernard L. Madoff Ponzi Scheme and How to Improve SEC Performance

United States. Congress. Senate. Committee on Banking, Housing, and Urban Affairs. - Tax Issues Related to Ponzi Schemes and an Update on Offshore Tax Evasion Legislation

United States. Congress. Senate. Committee on Finance. - Investigation of Failure of the SEC to Uncover Bernard Madoff's Ponzi Scheme

United States. Securities and Exchange Commission. Office of Investigations.

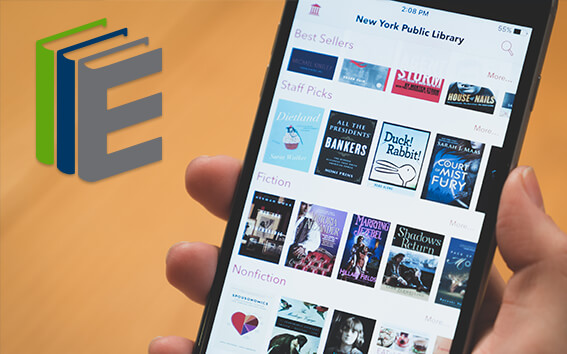

Read E-Books with SimplyE

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

If you don’t have an NYPL library card, New York State residents can apply for a digital card online or through SimplyE (available on the App Store or Google Play).

Need more help? Read our guide to using SimplyE.

Comments

Well done...

Submitted by Andrew (not verified) on July 31, 2012 - 5:44am