SIBL's April 2016 Financial Planning Day in Retrospect

April 29, 2016 was the semi-annual Financial Planning Day at the Science, Industry, and Business Library. The next one is on Friday, September 23, 2016. I have been meaning to attend the event for years, and I finally made it this time. The event was spectacular, and it surpassed all of my expectations. I received great financial and legal advice, and I even got free tickets to the Museum of American Finance! The following are four fascinating financial classes, a small piece of the twelve possible offerings at this awesome event.

Reactive vs. Proactive Job Hunting

Jackie Rose, a volunteer career coach at SIBL, is passionate about helping people find jobs. She discussed reactive vs. proactive tasks in job hunting. Responding to ads on a job board is reactive. Creating a resume and researching companies' web sites is proactive. Conducting informational interviews with key people in the industry who can talk to job hunters about how to get involved in the career is vital. It is important to note that up to 30% of the jobs that are posted online do not exist. Companies may have candidates in mind for them, but they are legally required to post them.

I asked if dates of graduation can be left off of resumes in order to combat ageism. Rose responded that this practice is commonplace, but recruiters are fully aware that resumes with no graduation dates have not been written by people in their thirties. She stated that improving profitability and company efficiency are key points to include on resumes. Experience that is relevant to the jobs that are being applied to should be included on the resume. Tasks that the worker does not enjoy or that were done more than a decade earlier should be left off of resumes.

When applying for positions, research the companies that hold those jobs. Look at the mission statements and history of the company. Keep an eye out for business news concerning the company. Current business trends of the company can be mentioned in the cover letter in order to communicate to recruiters that the applicant is following what is going on with the company. Type in the job title that you are applying for and the company name in LinkedIn.

You may know some or one of those people, who you could then contact for an informational interview to learn more about the position and the company. People should never ask for jobs during informational interviews. It is important to go to these meetings prepared with questions. One question that people can ask is about the career path of the business person. They can ask how they got to the position that they are in now. Research the company and the industry prior to these meetings so that the person will feel that you have done your homework. You can offer to buy the employee coffee or take them out for a drink after work. You may have to contact a few people before you get a position answer; persist!

Be aware that LinkedIn is regularly trolled by head hunters. Even if a company is laying off workers, still consider employment there. There may be a good explanation for the company's tactics. The most important things are listed first on job ads. When considering accepting a position, be wary of probationary periods; some companies have a 30-day and some have a 90-day probationary period. During this time, workers do not get benefits, and they can be dismissed at any time for any reason.

Social Security: Part of Everyone's Financial Plan

I was impressed when someone informed me that she learned much about benefits that she did not realize that she was eligible for during an in-person meeting with a rep from the Social Security office. Employees from Social Security talked about financial benefits to retirees and their dependents, disabled workers and their dependents, widows and widowers and surviving children of deceased workers. The staff were very knowledgeable about the intricacies of Social Security.

Social Security has a publication on their web site called When to Start Receiving Retirement Benefits. The web site also has a Retirement Estimator to help people determine when to retire. You have to work in order to receive retirement benefits from Social Security. Your benefits will be based on your highest 35 years of work income. Retirement age is determined by your year of birth. Most people's full retirement age is 67 years, when you can receive 100% of your benefits. If you wait until age 70 to apply for benefits, you can receive 132% of your benefits every year for the rest of your life. Cost-of-living increases are granted from time to time. It is financially advantageous to wait until you are 70 years of age if you can possibly afford to do so.

In some cases, you can continue working and still receive retirement benefits, if you income is under a certain level or you are over a certain age. Social security benefits are taxable, and you can apply on the web site. If you are currently married or you were married for at least a decade, you could qualify for benefits under your spouse's social security number. Keep that number handy because the Social Security Administration may not be able to locate it. Same-sex couples are eligible for benefits. However, you are not eligible for any benefits under your spouse if you murder him or her. In order to learn about how to prevent fraud, visit the Antifraud Facts on the web site. SSA is on Facebook, twitter and YouTube.

Asset Allocation

It is important to have a diverse portfolio of investments. The three stages of wealth are asset accumulation (happens in 20s - 40s), capital appreciation (30s - 40s) and capital distribution (60s - 90s). You must know your risk tolerance and how much money you are comfortable with potentially losing. This helps you make careful investment choices. Everyone needs an emergency savings account to cover six to nine months of living expenses. Stocks can give the best returns but also generate the biggest losses.

If you hire a certified financial planner (CFP), make sure that you are paying for their advice, not a product. Fixed income generates dividends. International investments increase diversification, but be careful of the security of certain markets overseas. Look at the top ten holdings of mutual funds so that you can see what the fund is investing in. Having different mutual funds with the same holdings will not accomplish diversification. Do not make emotionally charged decisions as a result of wild fluctuations of the stock market; this can result in huge financial losses. Kids and adults need to be taught financial literacy in this country since so many people do not know much about this topic.

Wills and Advance Directives

Stacy Pramer is a volunteer attorney for the City Bar Justice Center-New York Bar Association. She discussed wills and advance directives. These documents vary by state law. The basic form when people think of a "will" is the Last Will and Testament. However, there are three ancillary documents that can be attached to this, called advance directives: living will, health-care proxy and power of attorney. All documents are necessary, and Pramer recommended obtaining an attorney's services for will preparation since they possess an understanding of the intricacies of the law that lay people may not.

Living Will

This document describes how you wish to leave this world in detail. You can choose the way in which you would like to die and your wishes about health-care at the end of life if you are not able to communicate at that time. This includes wishes about cardiac resuscitation, pulmonary respiration, artificial hydration and nutrition, antibiotics for treatment of infection and pain medication. You can elect to accept or refuse each of these treatments.

Health-Care Proxy

This is a designation of someone to make health care decisions for you if you cannot do so yourself. It must be one adult, and not your physician since that presents a conflict of interest. Preferably, this person is local, since it would be easier for them to act on your behalf. It is useful to provide your physician with a copy of this form. It has a section on organ and tissue donation. You can change this document at any time. It is important to communicate your wishes with your loved ones and other people in your life to ensure that your wishes are carried out.

Power of Attorney

This gives an adult who is not a felon the ability to make financial decisions for you. He or she can invest, buy and sell real estate on your behalf, etc. This is deemed effective as soon as it is completed unless you revoke it. Therefore, do not give it to your agent until you want it to take effect.

Last Will and Testament

If you die without a will, your belongings will go according to New York State laws of distribution, or the laws pertaining to whichever state you live in. Many people make wills in order to prevent this from happening. Beneficiaries on financial accounts supercede wills. Estate taxes can be large. Be aware that instructions given outside the context of a will are not legally binding. Some people have digital assets, such as web site, which can also be left to a designated person. Handwritten wills are not recognized by many states.

Four fascinating financial classes at the Science, Industry and Business Library of NYPL. It was definitely worth the trip! Mark your calendars for the next Financial Planning Day on September 23, 2016! I am very much looking forward to attending this event again.

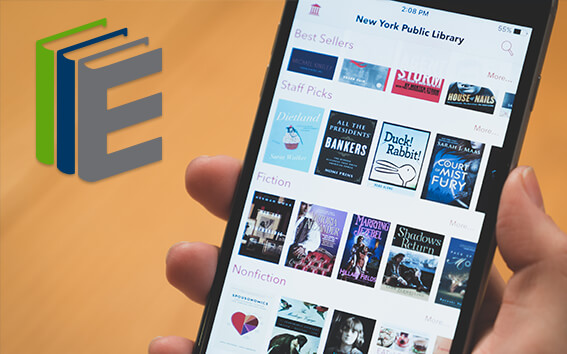

Read E-Books with SimplyE

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

If you don’t have an NYPL library card, New York State residents can apply for a digital card online or through SimplyE (available on the App Store or Google Play).

Need more help? Read our guide to using SimplyE.