Paperless Research

Morningstar Investment Research Center

When my interest was piqued about personal finance two years ago, I read many books about the subject and I attended database classes. Morningstar is a reputable financial evaluator that has helped me choose good mutual funds for my individual retirement account (IRA) and personal investments. It is invaluable, and I have learned much about finance from this database. The TV show, Nightly Business Report, also provides much information about personal investment choices.

When my interest was piqued about personal finance two years ago, I read many books about the subject and I attended database classes. Morningstar is a reputable financial evaluator that has helped me choose good mutual funds for my individual retirement account (IRA) and personal investments. It is invaluable, and I have learned much about finance from this database. The TV show, Nightly Business Report, also provides much information about personal investment choices.

Investment Information

There is a plethora of information about companies that one can purchase stocks in, mutual funds, and electronic transfer funds (ETFs) in this database. Morningstar provides star and color ratings. Five stars is the best star rating, and gold is the best color rating. I usually shoot for four or five star gold and silver mutual funds. You can also see the proportion of stocks versus fixed funds in each mutual fund. You can read the financial professionals’ opinion of and forecast for the mutual funds. Information about the minimum investment amount for each fund, the ticker symbol and whether the fund is open for investment is provided.

Financial Analysis

Newsletters, articles and videos provide more information for those who would like to learn more about the financial market. This is up-to-date analysis of the financial services sector and the stocks and funds that are contained within. Becoming knowledgeable about financial trends can assist individuals with their investment choices.

Saving for Retirement

The Retirement Cost Calculator is a helpful way to forecast what one’s financial situation will be in one’s golden years. If the amount is too low, people can adjust their saving habits. Unfortunately, the rate of financial literacy in the United States today is alarmingly low. It behooves everyone to begin saving for and thinking about retirement as soon as they become adults.

Saving for College

The College Savings Calculator assists parents in saving for the kids’ tertiary education. College is a huge expense, and it is important to begin saving as soon as one conceives in order to ensure that the kids experience and enjoy their college years. This tool can help one determine if they are saving enough for college.

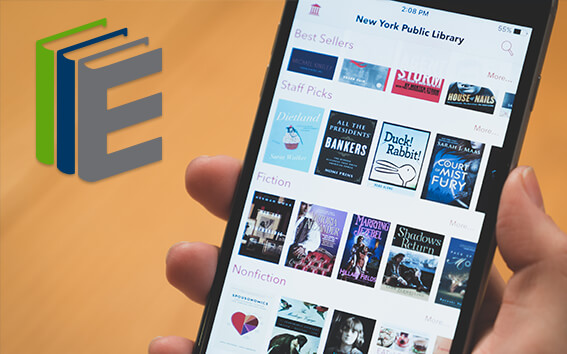

Read E-Books with SimplyE

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

If you don’t have an NYPL library card, New York State residents can apply for a digital card online or through SimplyE (available on the App Store or Google Play).

Need more help? Read our guide to using SimplyE.