A Common Sense Financial Advisor: A Chat with Steve Poppel

With SIBL's Financial Empowerment Day approaching on Saturday, April 21, I caught up with Steve Poppel, an independent financial advisor at NYPL's Financial Literacy Central. After our chat it's even clearer to me why Steve consistently receives 5-star reviews from his clients. Here's a preview of his common sense approach to helping clients improve their personal finances.

Steve, how did you find your way to NYPL's Financial Literacy Central?

In my thirty years in corporate finance I saw the toll on individuals when they made financial decisions with an incomplete understanding of what was involved. SIBL's Money Matters program lets me harness my previous experience in education (a decade of college teaching) to help level the playing field between individuals and financial service providers.

In my thirty years in corporate finance I saw the toll on individuals when they made financial decisions with an incomplete understanding of what was involved. SIBL's Money Matters program lets me harness my previous experience in education (a decade of college teaching) to help level the playing field between individuals and financial service providers.

You're described as an independent financial advisor. Please elaborate.

There are two aspects of "independent financial advisor" that deserve comment. The term "advisor" is something of a misnomer, since my intention is not to guide people's actions, but to help them get the information and develop the understanding that will enable them to make their own financial decisions. Knowing where you stand financially, and understanding your options are essential for charting a course in what is inevitably a world of great uncertainty.

The second comment relates to the term "independent." Just as independent references like Consumer Reports can be a big help for a car buyer, independent sources of information are invaluable to a user of financial services. And that's where SIBL's Financial Literacy Central, and the related Money Matters programs in the branch libraries, come in. Through them the Library is expanding its traditional roles by providing specially-assembled collections of reading materials, a trove of on-line resources, lecture series and workshops, and the great program of individual financial counseling that I help with. Like your coaching clients who appreciate how you clarify financial terms for the layman, I love the way your presentations like this short video clip demystify the concept of interest using examples as different as eggs and autos.

Like your coaching clients who appreciate how you clarify financial terms for the layman, I love the way your presentations like this short video clip demystify the concept of interest using examples as different as eggs and autos.

Many of the central concepts in personal finance are matters of common sense captured in adages about "living within your means," "not putting all your eggs in one basket," and realizing that "there is no such thing as a free lunch." After all, it's these everyday truisms that lie respectively behind such key concepts as budgeting, risk diversification, and the relationship between risk and reward.

Take budgeting... When a credit card offer promises that "You can spend money you don't have," the claim defies logic. You can't do that any more than you can drive a car that you don't have. If you want to go for a ride, you need to rent the car, and that costs money. In the same way, renting money costs money, and the consumer needs to be equipped with ways of thinking about whether it's worth doing that.

Risk diversification is what's behind mutual fund investing. Knowing what asset classes a fund holds, whether the strategy is active or passive, and what expenses are coming out before, during, and after the investment help an individual know what's going on, and how to act.

And then there's that non-existent free lunch that helps explain the relationship between risk and reward. It can be a real eye-opener just to sketch the graph that shows the characteristic returns for cash, bonds, and stocks, with the volatility that typifies stocks. It's also illuminating to remind people that another word for a "stock" is a "share," which represents a pro-rata participation in a company's financial performance — with all the uncertainty that that entails.

I've heard you say that it's really important to get clients to ask the right questions. Can you give an example?

Here's one. If someone comes in asking whether she has the right investments, I show her how to understand her investment goals, and her risk appetite, and how to choose investments accordingly. Having people address questions like these in the midst of SIBL's fantastic resources for answering them can be very productive.

How does the shift from defined-benefit pension plans to a defined-contribution arrangement affect Americans' need for personal financial education?

This shift means that now individuals need to be their own Investment and Financial Managers, which in most cases is a new responsibility. That's a challenge that's fraught with peril as well as opportunity. The more one can learn, the better equipped he'll be to take it on.

At SIBL you meet with patrons with different needs and varying levels of knowledge, incomes, and savings. Given this client range is it possible to recommend reading for folks all along the spectrum?

Staying on top of current affairs in every regard is the start. I prefer reading to TV (which I find to be 24/7 noise, where it's hard to pluck out what's of value), so I welcome the New York Times' coverage of politics and culture as well as economics and business. National Public Radio is my regular morning companion, and their Marketplace programs are especially helpful for understanding what's going on in business and finance.

One of my favorite books on investing is Burton Malkiel's A Random Walk Down Wall Street. This classic lays out the rationale for low-cost index-based mutual fund investment, which is a good baseline strategy for the average individual. Another item that I frequently recommend, when people ask for advice about retirement, is the Internal Revenue Service's Publication 590, on Individual Retirement Arrangements, which clearly describes the various options for tax-sheltered retirement saving.

As for more general recommendations, this is one area where I'm glad to defer to the Library's reference staff. Not only do they know what the Library has, they also have the experience to know what works for different people who come to these subjects with various backgrounds and needs. Didn't one of your blog postings include a list of the ten personal finance titles that had each been borrowed from Financial Literacy Central more 100 times last year?

Your recent Wall Street Journal blog underscored your belief that not just individuals but the wider community benefit when people make informed financial decisions.

Right! The more knowledgeable, critical, skeptical, and discerning individual investors are, the more impetus financial service providers will have to shape offerings that serve their clients' best interests. And that will improve the opportunities for every individual investor.

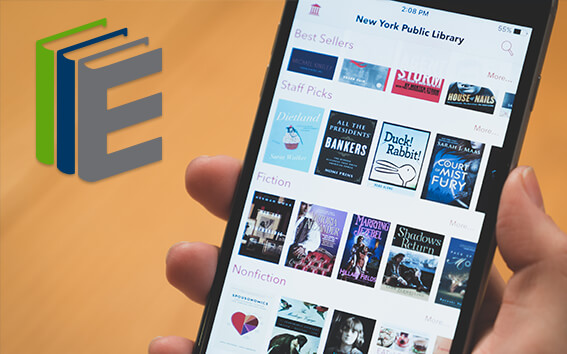

Read E-Books with SimplyE

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

With your library card, it's easier than ever to choose from more than 300,000 e-books on SimplyE, The New York Public Library's free e-reader app. Gain access to digital resources for all ages, including e-books, audiobooks, databases, and more.

If you don’t have an NYPL library card, New York State residents can apply for a digital card online or through SimplyE (available on the App Store or Google Play).

Need more help? Read our guide to using SimplyE.